Commercial solar power is one of the most effective ways your organisation can take control over your electricity costs. There are many finance options available to businesses and one of the most popular is a cash purchase (capex) arrangement. A cash purchase allows your organisation to achieve the highest returns from installing a commercial solar power system; however it requires an initial upfront investment in the system.

Payback periods range between 2.5 – 6 years depending on your location, energy usage and electricity tariffs. Todae Solar is able to provide a business case which will enable your business to understand the viability of solar.

A cash purchase generates the cheapest LCOE (Levelised Cost of Electricity) over the life of the system, this can range from 3-8c/kWh over a 20 year period.

Yes – System is paid for upfront.

Customer owns the system outright.

Customer can claim depreciation over 20 year period.

Todae Solar can provide an Operations & Maintenance plan.

No term – system is owned outright by the customer.

Minimal or no ongoing costs.

Yes – depending on the system size this can range up to 60% of the system cost.

The customer is responsible for insurance of the system.

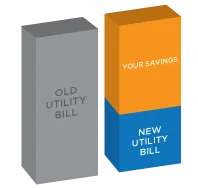

A cash purchase enables your organisation to directly receive the cost savings from the solar energy created – effectively giving your business free electricity for 20 years plus. As there are no ongoing costs or repayments this provides the greatest overall savings from solar.

Electricity prices have risen significantly and are expected to continue to rise over the next decade. A commercial solar system will cover a portion of your electricity usage (up to 60%) and any price increases will not affect the energy generated from your solar system. Any increases in electricity costs will likely mean that your organisation receives more savings for the electricity your system generates.

A capex arrangement provides the lowest Levelised Cost of Electricity. This can be between 2-8c/kWh over the 20 year lifespan of the system. As there are minimal or even no on-going costs, this arrangement delivers the lowest cost of power over the long term.

A commercial solar system is effectively an asset on your building/premises. This will add value to your property and provide a depreciation benefit over the 20 year lifespan.

A cash purchase enables your organisation to directly receive the cost savings from the solar energy created – effectively giving your business free electricity for 20 years plus. As there are no ongoing costs or repayments this provides the greatest overall savings from solar.

Electricity prices have risen significantly and are expected to continue to rise over the next decade. A commercial solar system will cover a portion of your electricity usage (up to 60%) and any price increases will not affect the energy generated from your solar system. Any increases in electricity costs will likely mean that your organisation receives more savings for the electricity your system generates.

A capex arrangement provides the lowest Levelised Cost of Electricity. This can be between 2-8c/kWh over the 20 year lifespan of the system. As there are minimal or even no on-going costs, this arrangement delivers the lowest cost of power over the long term.

A commercial solar system is effectively an asset on your building/premises. This will add value to your property and provide a depreciation benefit over the 20 year lifespan.

As Australia’s #1 commercial solar installer we can help your business take advantage of solar. Hundreds of organisations around the country have partnered with Todae Solar to implement solar from SME’s to large corporates like Stockland and Woolworths. We’ll provide you with an easy to understand business case analysing the different financial options available. Once you’ve decided which option is the best for your organisation, we’ll take care of the rest from start to finish – so you can focus on running your business. Contact us for a free consultation and see how much you can save with solar.

Todae Solar offers a range of solar financing options to provide your organisation with the best solution for your business requirements. Our consultants will work with you to help determine the right finance solution for you.

© Copyright 2026 Todae Solar. All rights reserved